‘Violent’ bought 3,000 electric cars, Sun Taxi was burdened with debt and loss

The financial situation is difficult due to many years of business losses and negative equity, but Sun Taxi Joint Stock Company decided to “play big” when violently signed a contract to buy 3,000 cars. power VinFast VF 5 Plus.

On the first day of June 2023, Sun Taxi Joint Stock Company caused a stir when signing a contract to buy 3,000 VF 5 Plus electric cars to add to the fleet of petrol cars currently in operation. This is the largest car purchase contract in Vietnam so far, with a handover time from now to 2025.

In the first phase, Sun Taxi will deploy electric taxi services in provinces and cities including Quang Binh, Hue, Quang Nam, Quang Ngai, Binh Dinh, Phu Yen, Nha Trang (Khanh Hoa), Phan Thiet (Binh Thuan). , Gia Lai and Kon Tum. It is expected that by 2025, all 3,000 VinFast electric cars in Sun Taxi’s fleet will roll out across the country.

Whose is Sun Taxi?

Sun Taxi Joint Stock Company was established on June 3, 2014, main activities in the field of road transport business (mainly taxi services). As a taxi brand originating from Khanh Hoa and positioned as a “cheap taxi” brand, Sun Taxi has quickly expanded its operation area to many neighboring provinces and cities in the Central and Central Highlands regions (Phu Yen province). , Binh Dinh, Ninh Thuan, Binh Thuan, Quang Binh, Quang Tri, Dak Lak, Kon Tum, Gia Lai…) and recently expanded into the southern region.

Although the charter capital is not large, in terms of coverage of the operating area, Sun Taxi is currently only behind “elder” Mai Linh and more than Vinasun. In recent years, Sun Taxi has also expanded its electric car service in Binh Dinh, Jeep taxi in Phan Thiet…

In addition to taxis, Sun Taxi also participates in bodyguards with Truong Quan Bodyguard Service Company, hotels and entertainment services such as discos, spas, etc. with 24 member companies. Currently, Sun Taxi owns a restaurant – Sunny Hotel in Ho Chi Minh City. Phan Rang.

Sun Taxi has an initial charter capital of 30 billion VND, founded by founding shareholders: Mr. Nguyen Duy Hung (holding 76%), Mr. Le Quoc Hung (holding 5%) and Ms. Nguyen Thi Huong (holding 19%). By 2016, the company increased its capital to VND 50 billion, of which Mr. Nguyen Duy Hung increased his ownership rate to 78.4%; and Mr. Le Quoc Hung and Ms. Nguyen Thi Huong reduced their ownership rates to 4.5 and 17.1%, respectively.

Mr. Nguyen Duy Hung is currently the Chairman of the Board of Directors of Sun Taxi and the legal representative of this company.

Loss of business, negative equity, high debt

According to data from VietnamFinance, in the last 3 years, Sun Taxi’s total assets have been shrinking day by day. Specifically, from 618.4 billion VND in 2020, the assets of this business will decrease to 540.7 billion VND in 2021 and only 444.5 billion VND in 2022.

Sun Taxi’s main funding source is debt loans. Although this amount of debt has decreased in the past 3 years, it is still not significant. From 627.4 billion dong in 2020, the enterprise’s liabilities will decrease to 617.1 billion dong in 2021. As of the end of December last year, Sun Taxi’s liabilities stood at 553.1 billion dong.

The majority of Sun Taxi’s debt is short-term debt, especially liabilities and financial loans. As of December 31, 2022, Sun Taxi’s short-term debt is 134.7 billion VND and long-term debt is 112 billion VND.

In the opposite direction, Sun Taxi’s equity is becoming more and more negative. From negative 53 billion dong in 2020, enterprise’s equity will be negative to 152.6 billion dong in 2022.

The numbers shown on Sun Taxi’s balance sheet show that the company’s financial situation is difficult, the balance of capital is seriously imbalanced.

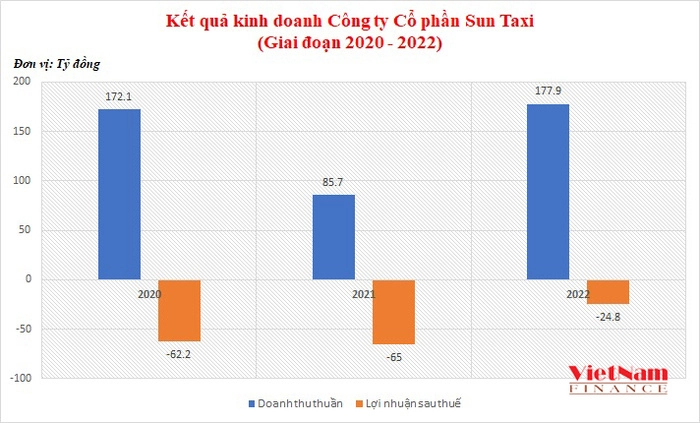

In terms of business results, as a service provider, Sun Taxi’s net revenue has also fluctuated continuously in the last 3 years. Accordingly, in 2020, the net revenue of this business will reach VND 172.1 billion, then decrease by 50% in 2021 to only VND 85.8 billion. After the epidemic situation is under control in 2022, Sun Taxi’s net revenue skyrocketed to VND 178 billion, equivalent to an increase of 108%.

However, because the cost of goods sold is always anchored at a high level, the remaining gross profit of Sun Taxi in the period of 2020 – 2022 is also not much. In 2020, Sun Taxi’s gross profit will reach 1.8 billion, by 2021 this business will do business below cost when the gross loss is 28.3 billion dong. This situation was later improved, helping Sun Taxi gross profit of 15.6 billion dong in 2022.

Thin gross profit cannot help Sun Taxi bear the costs of selling, managing the business and especially interest expenses. As a result, Sun Taxi continuously lost money, with losses of VND 62.3 billion (2020), VND 65 billion (2021) and VND 24.8 billion (2022).

With constant debt, Sun Taxi also continuously uses its assets to secure loans at banks and credit institutions in Khanh Hoa province.

According to data from VietnamFinance, each year, Sun Taxi uses dozens or even hundreds of cars as collateral. In addition to popular models such as Hyundai Grand, Toyota Vios, Toyota Innova… there are also luxury cars such as Mercedes-Benz, VinFast Lux A 2.0.

Stocks restricted from trading: How does the ‘big man’ of Da Nang Health Danameco do business?

The Hanoi Stock Exchange (HNX) has just issued a decision to bring DNM shares of Danameco Medical Corporation from being controlled to restricted from trading.

The reason DNM is restricted from trading is because this company is late in submitting its audited financial statements for 2022. Therefore, DNM’s shares are restricted from trading and can only be traded on Fridays. .

Accordingly, the submission of the above reports is prescribed in Point a, Clause 1, Article 39 of the Regulation on listing and trading of listed securities issued together with Decision No. 17/QD-HDTV dated March 31. 2022 of the Members’ Council, Vietnam Stock Exchange.

The Hanoi Stock Exchange requires that within 15 days from the date of issuance of the decision, Danameco must send it to this Department as well as disclose information with measures and roadmap to overcome the situation of restricted securities trading. .

On the side of DNM, this enterprise also had a document explaining the reasons and measures to remedy the situation that the securities of this enterprise were restricted from trading.

Thereby, this enterprise believes that due to changes in accounting personnel, especially the chief accountant, changes many times in 2022, so the process of working with the audit unit is interrupted and delayed.

The Board of Directors of this company is still working with the auditor to finalize this report. At the same time, this enterprise is also working closely with the audit to prepare the second quarter and semi-annual financial statements for the 2023 review to disclose information as prescribed.

In terms of business, this business achieved revenue in the first quarter of 2023 at VND 50.2 billion, only about 1/3 of the same period. Profit after tax dropped to negative 23.7 billion dong, while this index in the same period was 15.2 billion dong.

The capital structure of this enterprise is mainly debt with 347 billion dong, of which short-term liabilities account for 246 billion dong.

Large debt while equity is only 74 billion dong, has made the business face many risks. Because the ratio of liabilities / equity of this business is up to 25 times. Short-term debt/equity alone has increased to 18 times.

In terms of short-term solvency, this business is still able to pay its debts when the short-term asset / short-term debt ratio is above 1. In terms of quick solvency, when deducting inventory, this business is still able to pay at 0.6 times.